The past two years have taught us that risks in business are ever-present, ever-changing, and often completely unpredictable. It might not surprise you that business interruptions, natural catastrophes and cyber incidents are some of the top emerging business risks.

Legislation and regulation risk is nothing new to the business world, but as legislation and regulation evolve, so too do continued pandemic outbreaks, turning the business world upside down this year. As a prudent business owner, you want to protect your business’s current and future success from serious loss or financial hardship.

This two-part series will cover the top 5 emerging business risks in 2022, helping you identify critical threats that could be coming your way.

Let Barrack Broking clear the path forward for your business, so you can stay one step ahead of the risk curve.

Read on as we explore the top two emerging risks in 2022.

1. Cyber Incidents

The Covid-19 pandemic has increased digitalisation in businesses and homes. As a result, digitalisation advances are seeing an increase in what may have been considered infrequent cyber issues in the past.

According to the latest Allianz Risk Barometer results, 44% of the respondents cited cyber problems were their biggest concern, and ransomware attacks are the biggest threat in cybercrimes. These are proving to be damaging and expensive for many organisations.

Ransomware is the use of software that prohibits one from accessing a computer until one pays a certain amount of money. Commercialising cybercrime makes it easy for people to exploit vulnerable businesses on a massive scale.

Let’s look at other cyber risks for businesses:

Endpoint Attacks

More businesses are transferring resources to the cloud and working remotely, increasing endpoint attacks. Hackers target workers’ devices and SaaS platforms to access private networks.

Businesses should carefully design policies around remote work, associated use of IT infrastructure, and access controls such as encryption, passwords and multi-factor authentication. All workers must meet these security standards before gaining access to prevent endpoint attacks.

Phishing

Phishing is when one clicks on malicious links or gives information to an imposter landing page. Malware then enters a device allowing cybercriminals access to private networks. Cybercriminals use their social engineering and impersonation skills to gain access.

Using Office 365 and Gmail in businesses can make it easy for cybercriminals to gain access.

Third-Party and Supply Chain Attacks

A third-party or supply chain attack is when someone hacks a supplier’s security system to access a business’s network. There is an increase of breaches via a supply chain which is dangerous.

Machine Learning and Artificial Intelligence Attacks

Cybercriminals are using machine learning and artificial intelligence to launch attacks. They can speed up and multiply the level of gaining access to crucial systems and sensitive data.

IoT Attacks

Internet of Things (IoT) relates to internet-connected devices such as laptops, tablets, appliances, medical devices, medical equipment, or security systems. The more connected devices, the higher the risk of cyber incidents.

Hackers can control IoT devices to access sensitive information, lockdown machines for money, or overload networks.

Ways to prevent cyber attacks

Controlling cyber incidents in your company requires you to do the following:

● Prioritise cyber in business decisions by integrating it into enterprise risk management strategies.

● Consult security leaders in business decisions that involve cybersecurity.

● Recruit cybersecurity talent to increase skills within your team. Skilled teammates respond to an attack immediately, preventing dangerous situations for the business.

Having adequate cyber liability insurance covers in place should be one of the top considerations in your business insurance pack.

2. Business interruptions

Business interruption is an operational risk that can be physical or virtual and interferes with a business’s ability to operate. Physical interruptions occur due to issues such as natural disasters or loss of key equipment or other business assets. Virtual interruptions could take the form of IT outages that occur accidentally or maliciously on your electronic equipment.

According to Allianz Risk Barometer, interruptions to business operation is the second most concerning business risk and seriously affects cash flow. The highest interruption risk relates to cyber incidents, which occur mainly by a ransomware attack and company lack of preparedness around digitalisation.

We discuss some of the physical causes of business interruptions:

Fire and explosion

Fire and explosion are readily understood business interruptions that continue to destroy businesses. The nature of operations of your business determines the level of risk for fire or explosion.

The risk is greater if you work with flammable fluids, combustible dust, electrical hazards, or complex machinery. Having a clear understanding of potential ignition sources and measures to prevent fire is critical in designing the optimum solution for fire protection to your business premises.

Machinery breakdown

Business machinery breakdown can lead to immediate, lasting effects on operations with sometimes fatal consequences. Broken or lost parts of machinery can slow or stop you from fulfilling orders resulting in unhappy clients, not to mention the costs of repairing or replacing equipment at short notice and often with significant lead times.

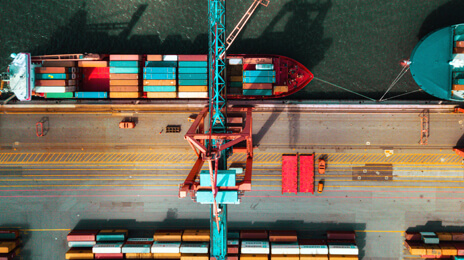

Supply chain disruptions

Supply chain disruptions lead to significant delays in delivering goods to customers or receiving goods from suppliers to Australian businesses. The pandemic demonstrated the weakness and fragile nature of supply chains. It is essential to prepare for disruptions in 2022 or risk having a broken supply chain, particularly if you’re in a retail business.

Many factors lead to supply chain disruptions, including:

● Climate-related occurrences

● Cyber attacks

● Political issues in a supplier’s country

● Data breach

● Suppliers not following new regulatory imperatives

● Border closures

Actions to take to mitigate long-term business interruption

● Prepare documented Business Continuity Plans that deal with immediate / emergency response, safety procedures and longer-term recovery. Your business plan is critical in helping keep you and your employees safe.

● Consider sprinkler installations or other fire protection in your facilities to reduce fire damage.

● Ensuring periodic maintenance of machinery to avoid breakdown.

● Purchasing and employing security cameras and educating your workforce to detect thieves and vandals.

● Purchase surplus stock from suppliers to reduce supply chain disruption risks.

● Have backup suppliers from other regions giving you different options if the primary supplier is unable to deliver.

● Conduct supplier audits to check all your supply chains and point out any potential risks.

● Consider insurance for business interruption risk exposures.

Barrack Broking can help you secure and negotiate a business insurance policy to get the best costs and cover options for your business risks. We’ll do a business risk review, risk retention analysis, and gap analysis for your business and provide professional advice on a custom solution.

Business interruption insurance covers in the event of these unforeseen disruptions, which is why we strongly advocate holding business interruption cover.

Protect your business risk with Barrack Broking!

2022 presents businesses with emerging risks that can lead to significant financial losses.

Do you need help to protect your business from emerging business risks in 2022?

At Barrack Broking, we recommend risk and insurance solutions for your business.

We offer the following services:

● Alternative Risk Transfer & Captives– Alternative Risk Transfer (ART) is the use of strategies other than traditional insurance and reinsurance to transfer your risk. This is particularly helpful in minimising your professional indemnity insurance and public liability insurance needs.

● Claims Management & Consulting – we create a strategic insurance program in unfortunate claim events. You will have satisfaction with how your insurance policy handles your claim throughout the claims process.

● General Insurance Broking– we develop an Insurance Program Strategy to ensure that your policies cover your current and future business risks, to suit your financial situation. Whether you’re looking for group insurance or small business insurance cover, we can help.

● Merger & Acquisition Services – we partner with clients to help them understand the liabilities, synergies, and risks associated with mergers and acquisitions.

● Risk Consulting – we provide risk consulting services to businesses to help them better understand their risk environment and proactively prepare.

Contact Barrack Broking today and keep your eye out for Part 2 of this series, where we explore natural catastrophes, the pandemic outbreak and changes in legislation and regulation, and how you can help protect your business.